Private equity

Tina Marie O’Neill, Donal Buckley, Killian Woods, Catherine Sanz and Emmet Ryan profile the key 100 individuals in the property industry

Claire Solon

Managing director, Greystar Ireland

Claire Solon set up the Greystar business in Ireland in 2019, which now has over €650 million in assets under management including almost 2,000 residential units and student accommodation units.

A global, vertically integrated residential platform specialising in private rented residential accommodation. Greystar owns a number of high-quality schemes in Ireland including Dublin Landings, Griffith Woods and Brickfield and almost 1,000 student beds at the Point Campus, all on Dublin’s northside, along with other development opportunities.

Prior to Greystar, Solon was head of property at Aviva Ireland where she managed acquisitions, disposals and redevelopment related to over €600m of property funds in Ireland and the UK.

Before that she was head of estates management at ESB Ireland where she managed the design and planning process for the award-winning ESB Headquarters office on Fitzwilliam Street Lower.

In 2016, Solon became the youngest person to be elected as president of the Society of Chartered Surveyors Ireland. She has also held a number of non-executive board memberships, including Home Building Finance Ireland (HBFI) and Clúid.

DB

Claire Solon set up the Greystar business in Ireland in 2019, which now has over €650m in assets under management including almost 2,000 residential units and student accommodation units

Brian Moran

Senior managing director, Hines Ireland

Since establishing Hines in Ireland in 2011, Brian Moran has built up a €3.1 billion portfolio of assets under management for the global investor. It includes shopping centres, student accommodation, apartments and offices with a total of 213,677 square metres of floor space in 10 projects.

He is also managing €1 billion worth of development on a 400-acre landbank including Cherrywood, where he built new parks and other core infrastructure, which was key to encouraging other developers, such as Cairn and Quintain, to develop there.

Hines retains key sites at the new town where it built and asset manages 1,269 apartments with Dutch pension fund APG, and more are in the pipeline.

Following the decision to refuse its plans for 1,592 apartments at the Clonliffe College site in Drumcondra, Dublin, Hines will submit a new planning application later this year.

Hines and German fund BVK have extended their Liffey Valley Shopping Centre and hope to see 1,000 apartments developed on an adjacent site.

In the city centre, most of its Central Plaza project is leased to WeWork and a new rooftop venue has been leased to NolaClan hospitality group.

DB

Niall Gaffney

chief executive, Iput Real Estate

Since becoming Iput chief executive in 2007, Niall Gaffney has transformed the Irish company into the largest owner of offices and logistics assets in Ireland with organisations such as AIB, Accenture and Microsoft among its tenant listings. Under his leadership, the firms net asset value has grown from €1.5 billion in 2007 to €2.7 billion at the end of 2024, while also delivering over €1 billion in returns to Iput shareholders over the last decade.

As an internationally recognised real estate brand, Iput has grown a substantial global institutional shareholder base, raising over €1.2 billion of equity from global real estate investors.

Gaffney has also put placemaking as a core strategy to create sustainable, high-quality urban environments that enhance the experience of people who work and live in Dublin. This is especially reflected in its Wilton Park city centre project and its plans for The Park retail park in Carrickmines.

In recognition of these efforts, Royal Hibernian Academy awarded Gaffney its Gold Medal in 2024, acknowledging his commitment to integrating art and architecture in Iput’s projects, thereby enriching Dublin’s built environment.

DB

Richard Barrett

Founder, Bartra

Richard Barrett bounced back from the impact of the 2008 financial crash on Treasury Holdings, which he had co-owned with Johnny Ronan, by founding Bartra which has more than €2 billion worth of diverse property developments. It also operates sister companies through four Middle East and Asian offices.

In Dublin, as well as developing offices projects such as The Sidings on Grand Canal Dock, it has also diversified into sectors traditionally eschewed by private Irish developers such as nursing homes and social housing.

Barrett has shown patience to take on controversial projects such as co-living, O’Devaney Gardens and developing in Bulloch Harbour, Dalkey. Broadcaster Pat Kenny and local residents won a High Court battle to prevent Barrett developing a four-bed apartment, three three-storey houses, a café, marine leisure facilities, a craft boat-building workshop and a public square at the harbour.

DB

CiarAn McIntyre

Head of Real Estate, Elkstone Partners

As a co-founder of Elkstone Partners, Ciarán McIntyre serves as head of real estate, managing the firm’s property investments and proptech opportunities. His responsibilities include sourcing investment deals, overseeing asset management and leading the execution of development projects.

With a career spanning over 25 years, McIntyre has accumulated extensive expertise in real estate. Under his leadership, Elkstone has been involved in significant projects, including a partnership with Harrison Street to develop a 345-bed purpose-built student accommodation in Galway. The project aims to address the rising demand for quality student housing in the region.

In addition to his work at Elkstone, McIntyre serves on the boards of companies such as N-Pro sports tech, contributing to industry discussions on property investment, technology and development strategies.

ER

Shane Scully

Founder and chief executive, Eagle Street Partners

Last year Eagle Street Partners, spearheaded by Shane Scully and backed by US investor Arrow Global, made one of its boldest moves with the purchase of The Square Shopping Centre in Tallaght for about €130 million. That was a little more than half the €250 million that Oaktree paid Nama for 90 per cent of the centre in 2019.

The Irish company is also well advanced on its residential projects at Dublin’s docklands developments where 13 cranes are coming down in preparation for the provision of some 1,250 new homes. These include units at Marshall Yards on East Road, a joint venture with Harrison Street which will accommodate 554 build-to-rent units, and 700 units at its Castleforbes site, in partnership with Nuveen.

Throughout his career, Shane Scully has been a key team member or leader involved in delivering thousands of new homes and purpose-built student accommodation beds, for example, the Binary Hub student accommodation in the Liberties, alongside some fine Dublin office buildings, most notably the Grant Thornton offices on City Quay, Dublin.

DB

Ronan Webster

Managing director and head of asset management, Henderson Park Ireland

Ronan Webster has transacted over €4 billion of commercial real estate investments in the Irish market since 2015. This includes his term with Green Reit, where he was asset management director with responsibility for leasing and the implementation of the reit’s asset management strategy.

He joined Henderson Park in 2020 after the UK investor took over Green Reit in a €1.34 billion deal, as he was well placed to continue the management of the Irish portfolio including key assets such as Central Park office complex in Leopardstown.

Since then, Henderson has also brought six of the Green properties to the market with the aim of raising around €445 million. These include the mixed-use Arena Centre in Tallaght priced at €45 million, as well as five city centre premises priced around €400 million, comprising One Molesworth Street, 2 Burlington Road, 5 Harcourt Road, 30 to 33 Molesworth Street, and Fitzwilliam Hall.

It intended deploying some €300 million of the sale’s proceeds to develop and optimise other properties including Horizon Logistics Park, close to Dublin Airport.

This newspaper reported that its main Irish operation recorded a €215.1 million impairment on its investment in subsidiaries in 2023.

DB

Peter Horgan

Managing director, Grayling Properties

Peter Horgan is the managing director and co-founder of Grayling Properties, a property development and management company established in 2018. His work focuses on delivering high-quality, design-led residential accommodation in city centres.

With more than 20 years of experience in the property and investment sectors, Horgan has a background that spans acquisitions, lease negotiations, planning and project management. Prior to founding Grayling, he co-founded Lugus Capital in 2013, where he led its residential operating and development platform.

Horgan’s expertise is particularly centred on Dublin’s private rental sector. Having worked at senior levels in leading investment firms, his focus is on understanding tenant needs, market trends and the evolving dynamics of urban property development.

ER

Eddie Byrne

Chief executive, Ires

Eddie Byrne was appointed chief executive of Irish Residential Properties Reit (Ires) in March 2024, succeeding Margaret Sweeney. Ires is Ireland’s largest private landlord, managing a substantial residential portfolio. Byrne’s responsibilities at Ires include overseeing rental operations, financial management, regulatory compliance and strategic planning for the company’s residential property portfolio.

Byrne’s background spans wealth management, real estate investment and property development.

Before joining Ires, Byrne held senior positions at Lone Star Funds, a global private equity firm with a focus on real estate and financial assets. He also served as chief executive of Quintain Ireland, where he oversaw major property development projects.

ER

Paddy McElligott

Head of Investment, Activate Capital

Since 2015, Paddy McElligott has been head of investment at Activate Capital, where he leads the firm’s investment strategy for financing residential and commercial property developments across Ireland.

Before joining Activate, McElligott was a principal at KKR, where he was involved in credit investment activities, including KKR’s initial investment in Activate. Prior to that, he worked as a director at Avoca Capital, focusing on high-yield corporate credit investments across Europe.

A chartered accountant, McElligott holds degrees in civil engineering and mathematics from Trinity College Dublin. He has also contributed to industry policy discussions through his role on the council of Property Industry Ireland, where he has chaired the finance policy committee.

ER

Eamon Waters

Founder, Sretaw

As a recent entrant to the Irish property scene, Waters, and his liquid cash, have been a welcome addition, especially during a commercial property slump plagued by high interest rates.

After selling his Beauparc Utilities, the waste and recycling group, for €1.3 billion in 2021, Waters established Sretaw (Waters spelled backwards), a private equity firm which has been on a bit of a spending spree around Dublin.

Investments have included a deal to acquire Merrion House, a prime Dublin 4 building overlooking Dublin Bay, the Victoria’s Secret store on Grafton Street, Royal Hibernian Way on Dublin’s Dawson Street, the Tesco premises on Lower Baggot Street, and the company that owns the Fade Street Social building from restaurateur Dylan McGrath.

Waters is surrounded by a savvy business team, which includes former FBD chief executive Fiona Muldoon and former KPMG director Fiachra Callanan.

CS

David Goddard

Chief executive, Lanthorn

Last summer, when it became known a number of senior Davy executives had handed in their notices, a lot of eyes were trained on what David Goddard would do next.

The long-time Davy executive has now branched out on his own and established Lanthorn, a commercial property vehicle that manages more than €1.6 billion worth of property, including Dublin’s St Stephen’s Green Shopping Centre.

The creation of Lanthorn came about after Goddard struck a deal to acquire Davy’s real estate business, which involved all 16 staff who were part of the unit joining the new firm.

Goddard, who had been with Davy since 1999, has managed property deals collectively worth billions of euros for clients during his time at the stockbroker. Since establishing his own firm, he has been busy acting on behalf of many of these same clients.

Earlier this year, his firm secured a deal to buy the Fleet Hotel in Temple Bar on behalf of TMR Hotel Collection, an investment firm connected to Austrian investor Thomas Röggla.

KW

Suzie Nolan

Head of Property, Aviva Life & Pensions

Suzie Nolan is the head of property at Aviva Life & Pensions Ireland, bringing over 18 years of experience in property fund management. She has managed properties and property funds internationally, establishing herself in a traditionally male-dominated industry.

She is responsible for all aspects of property fund management, including strategy, governance, stakeholder management, overseeing transactions, asset management and sustainability. Her notable recent projects include Zurich House and Blackrock Village Centre in Blackrock in Dublin as well as 18 Lower Leeson Street in Dublin 2.

Beyond her professional role, Nolan is deeply committed to promoting diversity in the workplace. She is a founding member of Aviva Ireland’s (Gender) Balance network and also supports the Irish chapter of the 30% Club, where she chairs the financial services group, and is an active member of the steering committee. She also represents the 30% Club on the Women in Finance Charter working group.

In recognition of her efforts, Nolan has been featured in the HERoes Women Role Model lists, being named a Future Leader 2022, 2023 and 2024.

TM

Deirdre Hayes

Irish Life Investment Managers

Deirdre Hayes is the head of Irish commercial property and ESG lead at Irish Life Investment Managers (ILIM), overseeing a portfolio exceeding five million square feet. Her role is to strategically drive fund and asset management initiatives and to enhance income and capital value through leasing, redevelopment and refurbishment projects for ILIM. Her latest redevelopment project release was the Cadenza Building on Earlsfort Terrace in Dublin 2.

Hayes also contributes to ILIM’s recognition in the Global Real Estate Sustainability Benchmark (GRESB) with multiple five-star fund ratings.

Before joining ILIM, Hayes spent almost five years as managing director of Aramark Property. Prior to that, she left Cushman & Wakefield (then DTZ Sherry FitzGerald) as a director to become a founding partner of HT Meagher O’Reilly (now Knight Frank).

Hayes holds a BSc in surveying from Trinity College Dublin and a diploma in property economics from Dublin Institute of Technology. She is a member of both the Society of Chartered Surveyors Ireland and the Royal Institution of Chartered Surveyors.

Under her leadership, ILIM received the Property Manager of the Year award at the European Pensions Awards in 2024. Hayes was also shortlisted for the ESG Leadership award at Mipim 2025.

TM

Dr Bill Nowlan

Founder, Oracle and Urbeo

Dr Bill Nowlan, a veteran of Ireland’s property industry, is best known for pioneering real estate investment trusts (Reits) in Ireland, which played a key role in shaping Dublin’s modern skyline. However, his true turning point came through his work with Focus Ireland, a housing charity where he chaired the property committee.

With a strong grasp of finance and deep frustration over Ireland’s housing crisis, the now 80-year-old has spent five years researching social housing funding models across Europe and the US, earning a PhD from Ulster University in 2018. His insights have since fuelled efforts to channel institutional capital into affordable housing.

Over four decades spent influencing the sector, he led major developments such as the Irish Life Centre and Ilac Centre, founded WK Nowlan Property, established Hibernia Reit and set up property consultancy Oracle Real Estate Strategies. He is the founding director of Urbeo Residential DAC, a social and affordable housing platform, and now advocates for urgent housing reform, calling for innovation in construction, increased affordability measures and better planning resources.

Nowlan was awarded the Lifetime Achievement award at the 2023 National Property Awards.

TM

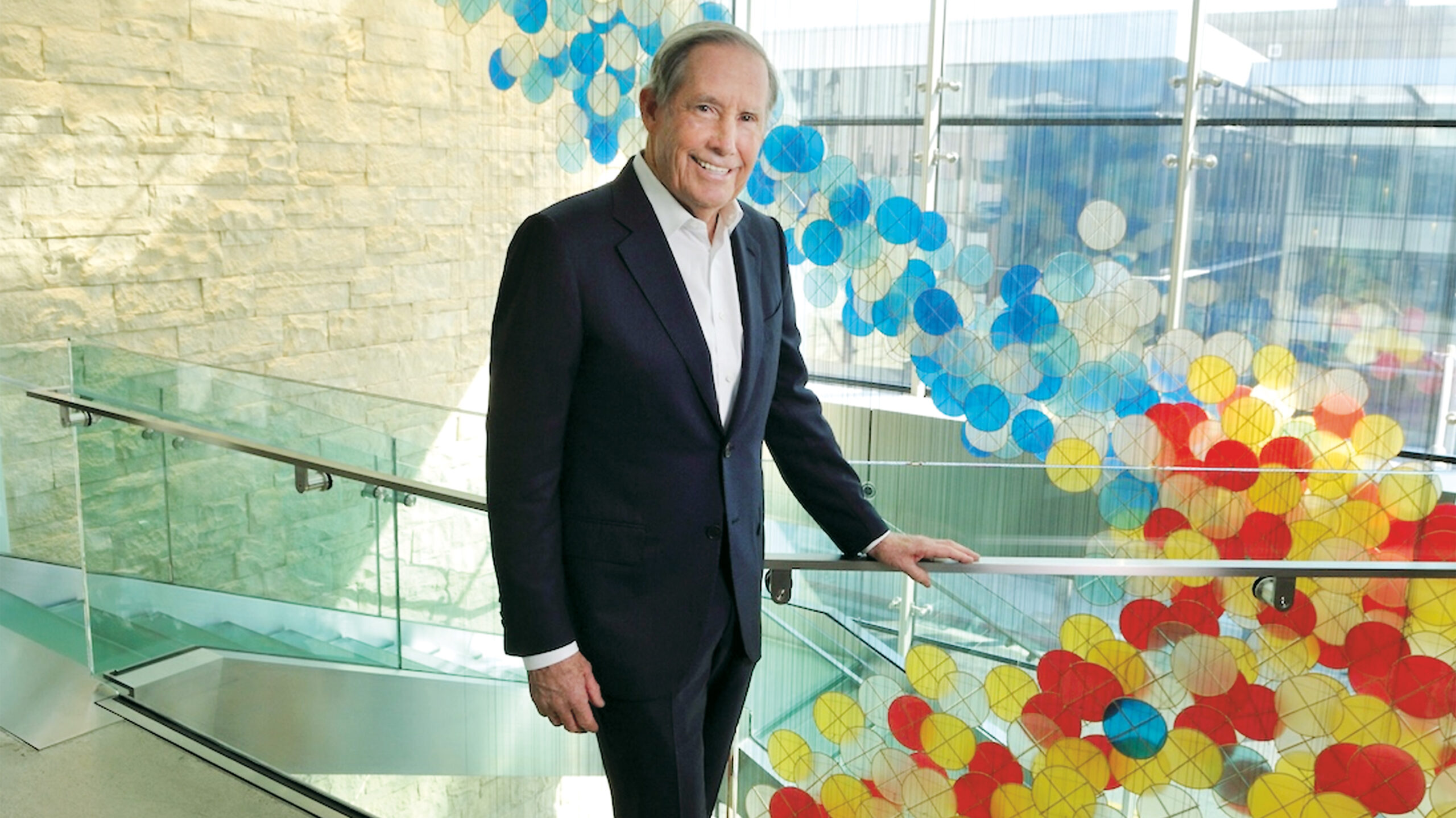

Bill McMorrow

Chairman and chief executive, Kennedy Wilson

Kennedy Wilson was one of the first US investors to enter the Irish market after the crash as Bill McMorrow recognised the opportunity to develop a long-term business here. Since 2011,Kennedy Wilson has become one of the largest property firms in Dublin with a portfolio which includes 3,500 multi-family units and 222,967 square metres of commercial space.

In addition to acquiring properties at keen prices, it also invested in adding new supply at a time when Irish banks could not lend for new development. It undertook the first new apartment development in Ireland after the crash, at Central Park, Leopardstown, and the first new office development at Capital Dock.

Recognising the iconic status of Dublin’s Shelbourne Hotel, it invested over €40 million in its upgrade before selling it last year for around €250 million. In all, McMorrow convinced the firm’s backers to invest over €3 billion in Ireland, developing nearly 2,000 new residential units and 139,350 square metres of commercial space.

Kennedy Wilson also introduced property management practices, for instance, residential tenant amenities and on-site management services.

DB

David Egan

Director, Head of Investment Management – Ireland, Patrizia

Patrizia, the German real estate investment firm, ranks as the second-largest independent real estate investment manager in Europe. Its real estate portfolio in Ireland is valued at about €720 million and is led by chartered surveyor and asset manager David Egan.

Notable acquisitions here include a €93 million build-to-rent development in Harold’s Cross, in Dublin, comprising 166 apartments, which it acquired from Marlet. Before that, it secured Ireland’s largest build-to-let apartment development in Honey Park, Dún Laoghaire for about €132 million.

It acquired the Eight Building in Dublin 8’s ‘hipster’ Liberties area for €60 million in 2022 shortly after purchasing two purpose-built student accommodation projects at Thomas Street and Highlight Parkgate in Dublin 7 with a total of 576 student units for €120 million.

TM

Colin MacDonald

Chief executive, Fine Grain Property

Fine Grain Property is an Irish-owned international commercial real estate investor, with more than €370 million invested in Ireland since 2016. The firm plays a key role in supporting foreign direct investment (FDI) by providing high-quality workspaces for global and Irish employers. Its portfolio spans 21 properties, totaling 1.3 million square feet and hosting more than 65 companies.

Founded in 2007 by chief executive Colin MacDonald, Fine Grain focuses on acquiring “overlooked or undermanaged” assets and enhancing their value through proactive management, ESG improvements, and tenant engagement. MacDonald, with over 30 years of banking and real estate experience in Asia and Ireland, previously held senior roles at HSBC, working in Singapore, Taiwan, Bahrain and Hong Kong.

The company, backed by the Grosvenor Estate and prominent European and Singaporean investors, recently completed its largest Irish deal with the €60 million acquisition of Connaught House, part of developer Johnny Ronan’s property portfolio.

Big ticket acquisitions and sales in its portfolio include the €65 million it paid in 2023 for five HQ blocks at Waterside, Citywest in Dublin 24 and the sale of the Hamilton House II office building in the Plassey Innovation Campus outside Limerick city for €14 million in January.

TM